A Guide to Buying Property in Cameroon

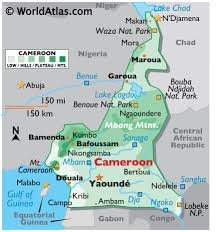

Cameroon is a country of immense potential, offering diverse opportunities for property buyers. From the bustling urban centers of Douala and Yaoundé to the serene coastal towns of Limbe and Kribi, the real estate market caters to a variety of needs. Whether you’re looking for a family home, an investment property, or land to develop, Cameroon’s growing economy and urbanization make it an attractive destination for real estate.

The Challenges of Buying Property as a Beginner

While the market is promising, navigating the process of buying property in Cameroon can be overwhelming, especially for first-time buyers. The challenges often include understanding legal requirements, identifying reliable sellers, and avoiding scams. Without the right guidance, the process may feel complicated and intimidating.

Purpose of This Guide

This blog aims to simplify the journey for beginners by breaking down the key steps involved in buying property in Cameroon. From market research to finalizing the transaction, you’ll find actionable advice and insights to help you make informed decisions. Whether you’re a local resident or part of the Cameroonian diaspora, this guide is your roadmap to secure and successful property ownership.

1. Research the Real Estate Market in Cameroon

Understand the Key Locations

When buying property in Cameroon, understanding the country’s diverse real estate market is critical. Major cities like Douala (Cameroon’s economic hub) and Yaoundé (the capital city) are hotspots for urban living and business opportunities. Coastal towns such as Limbe and Kribi are perfect for serene residential properties and tourism investments, while cities like Buea and Bamenda offer more affordable options with development potential.

Analyze Market Trends

Before making any decisions, keep an eye on market trends. Are property prices rising or falling in your area of interest? For instance, Douala and Yaoundé often experience steady growth due to high demand for urban housing and commercial spaces.

- Use platforms like Jumia House Cameroon or Property Cameroon to compare property prices.

- Follow local news outlets such as Journal du Cameroun for updates on infrastructure developments and policies affecting real estate.

Urban vs. Rural Property Investments

Decide whether you prefer an urban or rural investment.

- Urban areas: Offer better infrastructure, job opportunities, and higher property appreciation but come with higher prices.

- Rural areas: Provide larger plots of land at a lower cost, ideal for agriculture or private projects, but may lack basic infrastructure.

Local Insights from Real Estate Agents

Engage with local real estate agents or professionals to gain insights into neighborhoods, future developments, and high-potential areas. A good agent can also guide you on areas where property values are likely to increase.

Key Takeaway

Research is the foundation of successful property buying in Cameroon. The more you know about locations, trends, and investment potential, the better equipped you’ll be to make informed decisions.

3. Identify Your Property Needs

Define Your Purpose for Buying Property in Cameroon

Before diving into the property search, ask yourself: Why am I buying property in Cameroon?

- For Residential Use: Are you looking for a family home or an apartment in the city?

- For Investment: Do you plan to rent out the property or resell it for profit?

- For Development: Are you purchasing land for farming, construction, or business purposes?

Clearly defining your purpose will help narrow your options and ensure your property meets your needs.

Consider Location, Accessibility, and Infrastructure

The location of the property plays a significant role in its value and suitability.

- Urban Areas: If you need proximity to schools, hospitals, and offices, consider cities like Douala or Yaoundé.

- Coastal Areas: For a quieter lifestyle or tourism investment, explore Kribi and Limbe.

- Rural Areas: Perfect for large plots of land or agricultural projects.

Evaluate the accessibility of the area—proximity to roads, public transport, and essential amenities. Also, inspect the infrastructure, such as electricity, water supply, and internet connectivity, which are crucial for convenience and long-term satisfaction.

World Bank Cameroon Infrastructure Projects for updates on infrastructure development in the country.

Match Property Size with Your Needs

The size of the property you choose should align with your purpose.

- A small apartment may suit a single professional or a couple.

- A larger home or villa could be ideal for families.

- For business or farming, look for large plots of land with room for expansion.

Additionally, ensure the property has enough space for parking, gardening, or any other specific needs you might have.

Think Long-Term

Buying property in Cameroon is a significant investment, so consider future growth and potential.

- Is the area likely to see new developments, such as malls or schools?

- Will the value of the property appreciate over time?

Consult local real estate experts or check online platforms like Jumia Deals Cameroon to research properties in areas with high growth potential.

4. Hire a Trusted Real Estate Agent

Why You Need a Real Estate Agent When Buying Property in Cameroon

Navigating the process of buying property in Cameroon can be complex, especially for beginners. A trusted real estate agent can make the process smoother by:

- Providing access to verified property listings.

- Offering insights into the best locations and market trends.

- Guiding you through legal and administrative steps.

By working with a knowledgeable agent, you reduce the risk of scams and costly mistakes.

How to Find a Reliable Real Estate Agent

Here are some tips for finding the right professional:

- Check Their Credentials: Verify that the agent is licensed and has experience in the Cameroonian real estate market.

- Seek Recommendations: Ask friends, family, or colleagues for recommendations.

- Read Reviews: Look for online reviews or testimonials about the agent’s services.

- Interview Multiple Agents: Speak to at least two or three agents to understand their approach and expertise.

You can also explore platforms like Property Cameroon or Jumia House to connect with reputable agents.

Red Flags to Watch Out For

Not all agents are trustworthy. Be cautious if you notice any of these warning signs:

- Lack of Transparency: The agent avoids answering questions or providing clear documentation.

- Unrealistic Promises: Promising property deals that seem “too good to be true.”

- No Official Contracts: Refusing to sign formal agreements or demanding cash payments upfront.

Always prioritize agents who are upfront, professional, and transparent about the process.

Questions to Ask Your Agent

Before hiring an agent, ask the following:

- How many years of experience do you have in the Cameroonian market?

- Can you provide references from previous clients?

- What is your fee structure, and are there any additional costs?

- How will you ensure my property purchase is legally secure?

5. Conduct Due Diligence on the Property

Why Due Diligence is Crucial When Buying Property in Cameroon

Conducting thorough due diligence is one of the most important steps in buying property in Cameroon. This process helps you verify the authenticity of the property and ensures there are no legal or ownership disputes. Skipping this step could result in financial loss or legal complications.

Internal Link Suggestion: Link to a blog article on “Common Real Estate Scams to Avoid in Cameroon.”

Verify Property Ownership Documents

Start by requesting all legal documents related to the property. Key documents to verify include:

- Land Title: Confirms the property is registered with the land registry.

- Building Permits: Required for constructed properties to prove legal authorization.

- Certificate of Non-Encumbrance: Ensures the property is not tied to debts or legal disputes.

Visit the Cameroon Land Registry Office to confirm the authenticity of these documents. If possible, consult a real estate lawyer to review them for accuracy and completeness.

External Link Suggestion: Link to the Ministry of State Property and Land Tenure of Cameroon for more information on property registration.

Inspect the Property

Physically visit the property to confirm its condition and suitability. During the inspection, check for:

- Structural Issues: Cracks, leaks, or any signs of damage in buildings.

- Boundary Disputes: Ensure the boundaries match the land title or plot plan.

- Access to Infrastructure: Verify access to water, electricity, roads, and other essential amenities.

Consider bringing along a surveyor or an independent expert for a detailed evaluation.

Check for Property Disputes

Property disputes are not uncommon in Cameroon. Investigate the property’s history by speaking to local authorities, neighbors, or community leaders. They may provide insights into ownership conflicts or unresolved claims.

Use Trusted Professionals for the Process

To avoid falling victim to fraud or misinformation, hire trusted professionals, such as:

- A real estate lawyer to oversee the transaction.

- A surveyor to verify the property’s boundaries and size.

- A notary public to ensure the contract is legally binding and registered.

The Role of Lawyers and Notaries in Cameroonian Real Estate Transactions.”

Key Questions to Ask During Due Diligence

- Is the seller the rightful owner of the property?

- Are there any unpaid taxes or fees associated with the property?

- Is the property free from disputes or encumbrances?

Key Takeaway

Conducting due diligence when buying property in Cameroon is essential to avoid risks and ensure a smooth transaction. Verify documents, inspect the property, and engage trusted professionals to protect your investment.

6. Understand the Legal Process

Why Understanding the Legal Process is Important

When buying property in Cameroon, navigating the legal process is critical to ensuring your investment is secure and legitimate. Understanding the required steps not only protects you from fraud but also ensures the property is registered in your name. This section breaks down the legal procedures for property ownership in Cameroon.

The Importance of Legal Compliance in Real Estate Transactions in Cameroon.

Step 1: Sign the Purchase Agreement

The first legal step is to draft and sign a purchase agreement with the seller.

- The agreement should outline key terms, such as the property price, payment schedule, and any conditions of sale.

- Engage a real estate lawyer to draft or review the agreement to ensure it’s legally binding and clear.

Step 2: Conduct a Title Search

Before proceeding with payment, conduct a title search at the local land registry to:

- Confirm the seller is the rightful owner of the property.

- Verify that the property is free from liens, mortgages, or legal disputes.

This step is crucial for avoiding ownership complications.

Step 3: Notarize the Transaction

In Cameroon, all property transactions must be notarized to be legally valid.

- Both the buyer and seller must meet with a notary public, who will oversee the transaction and ensure it complies with the law.

- The notary will prepare the necessary documents, such as the sale deed or transfer deed.

Step 4: Pay the Required Taxes and Fees

Property transactions in Cameroon involve several taxes and fees, including:

- Registration Fees: Typically a percentage of the property value.

- Stamp Duty: Required for document authentication.

- Notary Fees: Charged for preparing and notarizing the transaction documents.

Ensure these payments are made promptly to avoid delays in the registration process.

Resource on Cameroon Land and Property Taxes for more details.

Step 5: Register the Property in Your Name

The final legal step is registering the property with the land registry.

- Submit all required documents, including the notarized sale deed, proof of payment, and the seller’s ownership documents.

- Once registered, you will receive the land title or certificate of ownership in your name.

This step is crucial as it establishes you as the legal owner of the property.

Tips to Avoid Legal Pitfalls

- Always work with trusted professionals, such as lawyers and notaries, to handle the legal process.

- Avoid rushing through any step—ensure all documents are verified and authentic.

- Be cautious of sellers who refuse to involve a notary or provide incomplete documentation.

Key Takeaway

Understanding the legal process of buying property in Cameroon is essential to securing your investment. From signing the purchase agreement to registering the property in your name, every step must be handled carefully and legally. Engage professionals to guide you through this process and ensure a smooth transaction.

7. Secure Financing for Your Property

Why Financing is Key When Buying Property in Cameroon

For many buyers, securing financing is a crucial part of the property purchase process. Whether you’re buying property in Cameroon for personal use or as an investment, understanding your financial options will help you plan better and avoid unnecessary delays.

Explore Financing Options in Cameroon

There are several ways to finance your property purchase, depending on your financial situation:

- Personal Savings: If you have enough saved, paying in cash can simplify the process and avoid interest payments.

- Bank Loans: Many banks in Cameroon offer mortgage loans for real estate purchases. Examples include:

- Afriland First Bank

- Ecobank Cameroon

- UBA Cameroon

- Cooperative Societies: Credit unions or cooperative societies like CAMCCUL can provide smaller loans with lower interest rates.

Each option comes with its terms, so evaluate them carefully before making a decision.

UBA Cameroon’s Mortgage Loan Page for more information on their financing options.

Understand Mortgage Loan Requirements

If you’re opting for a mortgage, banks typically require:

- A steady income source.

- A down payment, often ranging between 20-30% of the property’s value.

- Supporting documents, such as employment proof, tax returns, and property details.

Compare interest rates and repayment terms from multiple banks to find the best deal.

Prepare for Additional Costs

Apart from the property price, ensure you budget for additional expenses, including:

- Legal Fees: For hiring a lawyer and notary.

- Taxes and Registration Fees: Paid during the property registration process.

- Agent Fees: If you’re working with a real estate agent.

- Renovation or Maintenance Costs: If the property needs repairs or upgrades.

Being financially prepared for these costs will help you avoid unexpected financial strain.

Consider Alternative Payment Plans

Some property developers in Cameroon offer flexible payment plans, especially for off-plan projects. These allow buyers to pay in installments over an agreed period.

- Confirm that the developer is reputable and the project is legally approved.

- Ensure the payment terms are clearly outlined in a formal agreement.

Tips for Securing Financing Smoothly

- Work with a financial advisor to determine the best financing option for your situation.

- Maintain a good credit history to improve your chances of securing a loan.

- Keep all required documentation ready to avoid delays in the loan approval process.

Key Takeaway

Securing financing is an essential step in buying property in Cameroon. Whether you’re using personal savings, bank loans, or payment plans, having a clear understanding of your financial options will make the process smoother and less stressful. Be sure to budget for additional costs and explore flexible payment options where possible.

8. Close the Deal and Take Ownership

Finalizing the Property Purchase

After completing all legal and financial steps, the last phase of buying property in Cameroon is closing the deal. This stage formalizes the transaction and transfers ownership of the property to you. Paying attention to the details here is critical to ensuring your investment is secure.

Review the Sale Agreement One Last Time

Before signing the final documents, carefully review the sale agreement or contract of sale. Double-check the following:

- The agreed-upon purchase price.

- Payment terms and conditions.

- Specific details about the property, such as size, location, and condition.

- Any additional clauses, such as warranties or penalties for default.

Engage your lawyer or notary to ensure all terms are accurate and legally sound.

Make the Final Payment

Once you are satisfied with the agreement, proceed with the final payment.

- Always use traceable payment methods, such as bank transfers or checks, to keep a record of the transaction.

- Avoid making cash payments without receiving an official receipt.

Ensure that the seller provides proof of receiving the full payment before transferring ownership.

Transfer Ownership and Register the Property

The most critical step is registering the property in your name at the Land Registry Office. This process involves:

- Submitting all required documents, such as the notarized sale deed, proof of payment, and seller’s original ownership documents.

- Paying the necessary transfer fees and taxes.

- Receiving the updated land title or ownership certificate in your name.

Consult the Cameroon Ministry of State Property and Land Tenure for official guidelines on property registration.

Inspect the Property Before Moving In

Before taking full possession, inspect the property one last time to ensure it meets the agreed-upon condition. Check for any outstanding repairs or issues the seller promised to address.

Celebrate Your Investment

Once the ownership transfer is complete and you have the keys to your property, congratulations are in order! Buying property in Cameroon is a significant milestone, whether it’s for personal use or investment.

Key Takeaway

Closing the deal and taking ownership is the final and most rewarding step in buying property in Cameroon. By carefully reviewing documents, making secure payments, and properly registering the property, you can confidently take ownership of your new investment.

9. Maintain and Manage Your Property

Why Property Maintenance is Important

Buying property in Cameroon is only the beginning of your real estate journey. To protect your investment and maximize its value, regular maintenance and effective management are essential. Proper care ensures your property remains in good condition and retains or increases its market value over time.

Create a Maintenance Schedule

Regular upkeep prevents small issues from escalating into costly repairs. Here’s a basic maintenance checklist:

- Monthly Tasks: Inspect plumbing, electrical systems, and appliances for potential issues.

- Seasonal Tasks: Clean gutters, check the roof for damage, and ensure drainage systems are functional, especially during the rainy season.

- Annual Tasks: Repaint walls, deep-clean tiles and floors, and perform a full property inspection.

For landlords, regular maintenance keeps tenants happy and reduces vacancy rates.

Hire Professionals for Repairs and Maintenance

While some tasks can be DIY, others require professional expertise.

- For plumbing, electrical, or structural issues, hire certified technicians or contractors.

- Work with reliable cleaning services to keep the property in top shape, especially for rentals or commercial spaces.

Consider Property Management Services

If you own multiple properties or live abroad, hiring a property management company can save you time and effort. These companies:

- Handle tenant relations, including rent collection and lease agreements.

- Ensure timely repairs and maintenance.

- Provide detailed reports on property income and expenses.

Some reputable property management firms in Cameroon include Property Cameroon and Afriland Realty Solutions.

Insure Your Property

Property insurance protects your investment from risks such as fire, theft, or natural disasters.

- Consult local insurance companies like AXA Cameroon or NSIA Insurance to explore coverage options.

- Ensure your policy covers both the structure and its contents.

Get in touch with AXA Cameroon Insurance Services for more details on property insurance.

Stay Updated on Local Real Estate Laws

Real estate regulations in Cameroon may change over time. Stay informed about:

- Taxation Laws: Ensure you pay property taxes annually to avoid penalties.

- Zoning Laws: Understand land use regulations, especially if you plan to develop or renovate your property.

You can follow updates from the Ministry of State Property and Land Tenure or consult your real estate lawyer for guidance.

Enhance Property Value Over Time

To maximize your property’s long-term value:

- Consider upgrading features like energy-efficient lighting or modern appliances.

- Landscape the outdoor space to enhance curb appeal.

- Renovate periodically to keep the property in line with market trends.

Key Takeaway

Maintaining and managing your property in Cameroon is crucial for preserving its value and ensuring a steady return on investment. Whether through regular maintenance, professional services, or strategic upgrades, taking care of your property secures your investment for years to come.

Leave a Comment